I remember looking at my first investment statement. It was a mess of numbers and confusing names. I had no idea what I owned or why. If you've ever felt that way, you're not alone.

Let's talk about one of the simplest ways to start investing: the BlackRock Equity Index Fund. It’s a boring name for a powerful idea. Think of it like buying a tiny piece of every big company in America all at once. Instead of betting on one company, you own a piece of the whole pie.

In this review, we’ll break down what this fund is, how it works, and see how it compares to a similar one from Fidelity. We'll even clear up some scary-sounding news about BlackRock. It’s simpler than you think.

What is the BlackRock Equity Index Fund, Really?

Let's skip the finance jargon. An index fund is like a playlist of all the top songs. You don't have to pick each hit song yourself; you just press play on the whole "Top 100" chart.

The BlackRock Equity Index Fund does exactly that. Its "playlist" is the S&P 500 index. This is a list of 500 of the biggest and most important companies in the United States. When you buy a share of this fund, you instantly own a small piece of all 500 companies—from Apple and Microsoft to Coca-Cola and McDonald's.

The main goal is to grow your money slowly and steadily, right along with the U.S. economy. You won't get rich overnight. But you also won't lose everything if one company has a bad year. It’s a "set it and forget it" kind of investment.

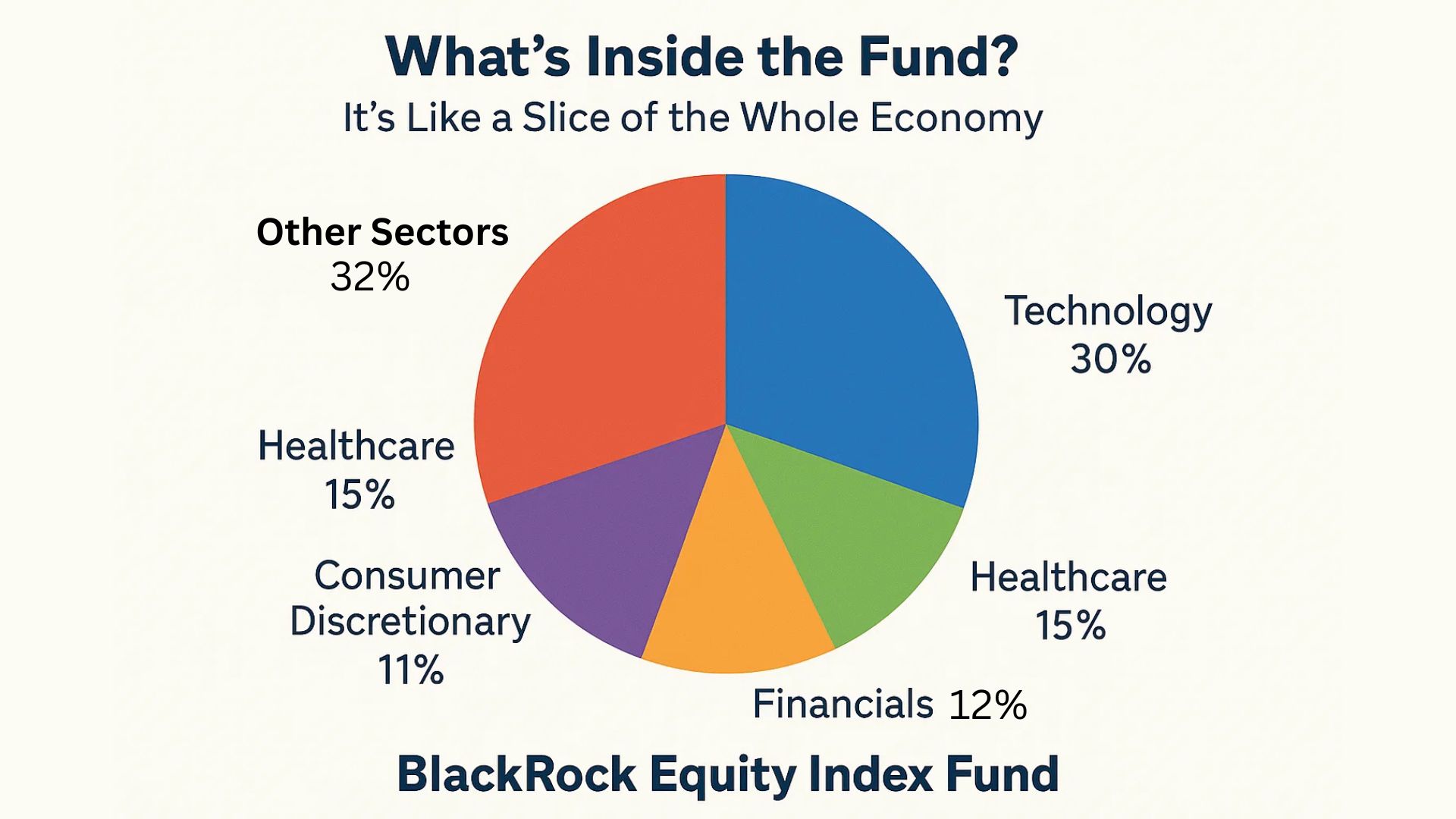

The Nuts and Bolts: What's Inside?

You don't need to know every company, but it helps to know what you're buying.

-

The Ticker: This is the fund's nickname on the stock market. For many versions of this fund, the ticker is MXEE. Always double-check the exact ticker symbol with your broker, as it can change.

-

The Holdings: The BlackRock Equity Index Fund holdings are basically the 500 companies in the S&P 500. The fund's managers don't pick and choose which companies to include. They just copy the list. This is called "passive" investing, and it's great because it keeps costs very low.

So, what are you actually owning? You own a slice of the technology you use, the food you eat, and the cars you see on the road. It’s a way of betting on the overall success of American business.

BlackRock vs. Fidelity: Which "Set-It-and-Forget-It" Fund is Better?

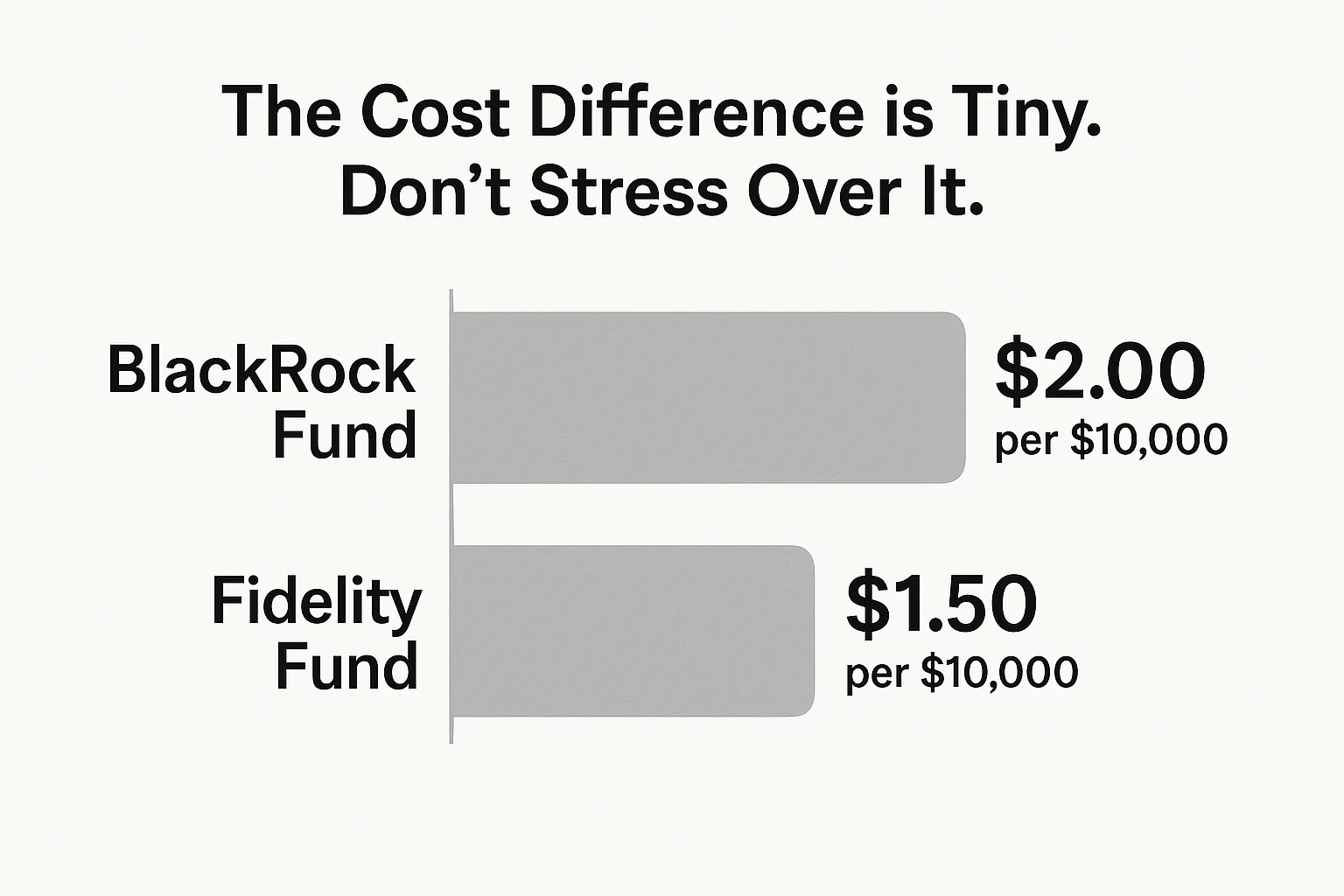

This is the big question. Both BlackRock and Fidelity offer S&P 500 index funds. They are like two different stores selling the exact same brand of cereal. The product is almost identical, so you shop based on price and convenience.

For most people, the decision comes down to two things: where your account is and the fees.

| Feature | BlackRock Equity Index Fund (Example) | Fidelity 500 Index Fund (FXAIX) |

|---|---|---|

| What it Tracks | S&P 500 | S&P 500 |

| Cost (Expense Ratio) | Very Low (e.g., 0.02%) | Very Low (0.015%) |

| The Main Difference | Often offered in workplace retirement plans (like 401ks) | A popular choice for individual brokerage and IRA accounts |

Here’s the simple truth: Both are excellent. The difference in cost is so tiny it's like choosing between a $5.00 bill and a $4.99 bill.

My advice? If you have a 401k at work and it offers the BlackRock fund, use it. It's a fantastic option. If you're opening your own personal investment account (like an IRA), you might find Fidelity's fund is just as easy to buy. The best fund is the one you can actually start using today.

Related : Types of Venture Capital The Simple Guide

Clearing Up the Confusion: BlackRock in the News

You might have heard some scary headlines. Let's talk about them in plain English.

-

"BlackRock Bankruptcy": This sounds terrifying, but it's not true for the fund you're investing in. A part of BlackRock did file for bankruptcy protection for a specific commercial real estate business. Think of it like this: If General Motors closed one of its car factories, it wouldn't mean your local Chevy dealership is going out of business. The BlackRock Equity Index Fund is a separate entity. It's protected. Your money isn't mixed with BlackRock's other business problems.

-

Mark Weidman BlackRock: Mark Wiedman is a key executive at BlackRock. He's involved in big global projects, like the BlackRock lithium contract. This is about BlackRock making deals to secure raw materials for the future. It shows the company is thinking ahead, but it doesn't directly change the day-to-day value of your S&P 500 fund.

The takeaway? Big companies do complicated things. Your index fund, however, remains a simple, straightforward collection of 500 other companies.

So, Is This Fund a Good Choice for You?

Ask yourself this: Do you want a simple, low-cost way to invest in the U.S. stock market without having to pick individual stocks?

If the answer is yes, then a fund like this is a perfect place to start. It takes all the guesswork out of investing. You won't beat the market, but you also won't tragically underperform it. Over time, the U.S. stock market has historically gone up. This fund lets you ride that wave.

The first time I understood this, it felt like a weight was lifted off my shoulders. I didn't have to be a stock-picking genius to be a successful investor.

Your Next Step

The hardest part is often just getting started. Open an investment account, whether it's through your job's retirement plan or one you set up yourself. Type in the fund's ticker, decide how much you want to invest, and hit "buy."

The next time you see a Starbucks, use your iPhone, or fill up your car with gas, you can smile. If you own this fund, you likely own a tiny, tiny piece of those companies.

FAQs

What does the BlackRock Equity Index Fund invest in?

It buys shares of all 500 companies in the S&P 500 index. This includes famous names like Amazon, Google, and Johnson & Johnson. You own a small piece of all of them.

Is my money safe if BlackRock has business trouble?

Yes. The fund's money is kept separate from BlackRock's own company money. It is held by a custodian bank for safety. Even if BlackRock had major issues, the fund's assets belong to the investors, not the company.

What is the difference between BlackRock and Blackstone?

They are two different companies. BlackRock mainly focuses on managed investment funds (like ETFs and index funds) for everyday investors. Blackstone focuses on private equity, like buying whole companies or real estate. They are not the same.

Can I lose all my money in this fund?

It is very, very unlikely. For you to lose everything, all 500 of America's biggest companies would have to go out of business at the same time. If that happens, we have much bigger problems. The fund's value can go down, but it's designed to be a safe long-term bet.

How do I buy the BlackRock Equity Index Fund?

You usually can't buy it directly. You need an account with a broker, like Fidelity, Vanguard, or Charles Schwab. You can also check if it's an option in your workplace 401(k) plan. You then use the fund's ticker symbol to buy it.