I once met an originator who had a crazy concept. He had an outline on a serviette, tons of energy, and no money. A year later, his company was thriving. This success came from working with the right financial expert. That is the control over wander capital.

It isn't fair money; it's rocket fuel for big ideas. But here's something many people don't realize: wander capital isn't one item. It's a huge universe of unique players, each with their own interesting role. Think of it as a school.

You have instructors for kindergarten, tall school science and advanced college courses. This direction is your invitation to that cosmos. We'll go over the different forms of venture capital, the careers available, and the trends that are changing everything. By the end, you'll not only understand how things function, but also where you might fit in.

What Is Venture Capital, Really?

Let's strip absent the favor language. At its heart, wander capital (VC) is cash given by financial specialists to startup companies with long-term development potential.

Read Also: 7 Simple Investment Strategies for Beginners

Why would anybody do this? It’s high-risk, high-reward. Most new businesses fall flat. But the one that gets to be the another Google or Tesla can return the whole fund's venture numerous times over. VCs aren’t fair giving out cash. They’re buying a piece of the company, a stake called value. They at that point roll up their sleeves to offer assistance that company develop, so their piece gets to be more valuable.

It’s a association. The author brings the vision and the work. The VC brings the capital, the organize, and the direction. Together, they attempt to construct something that changes the game.

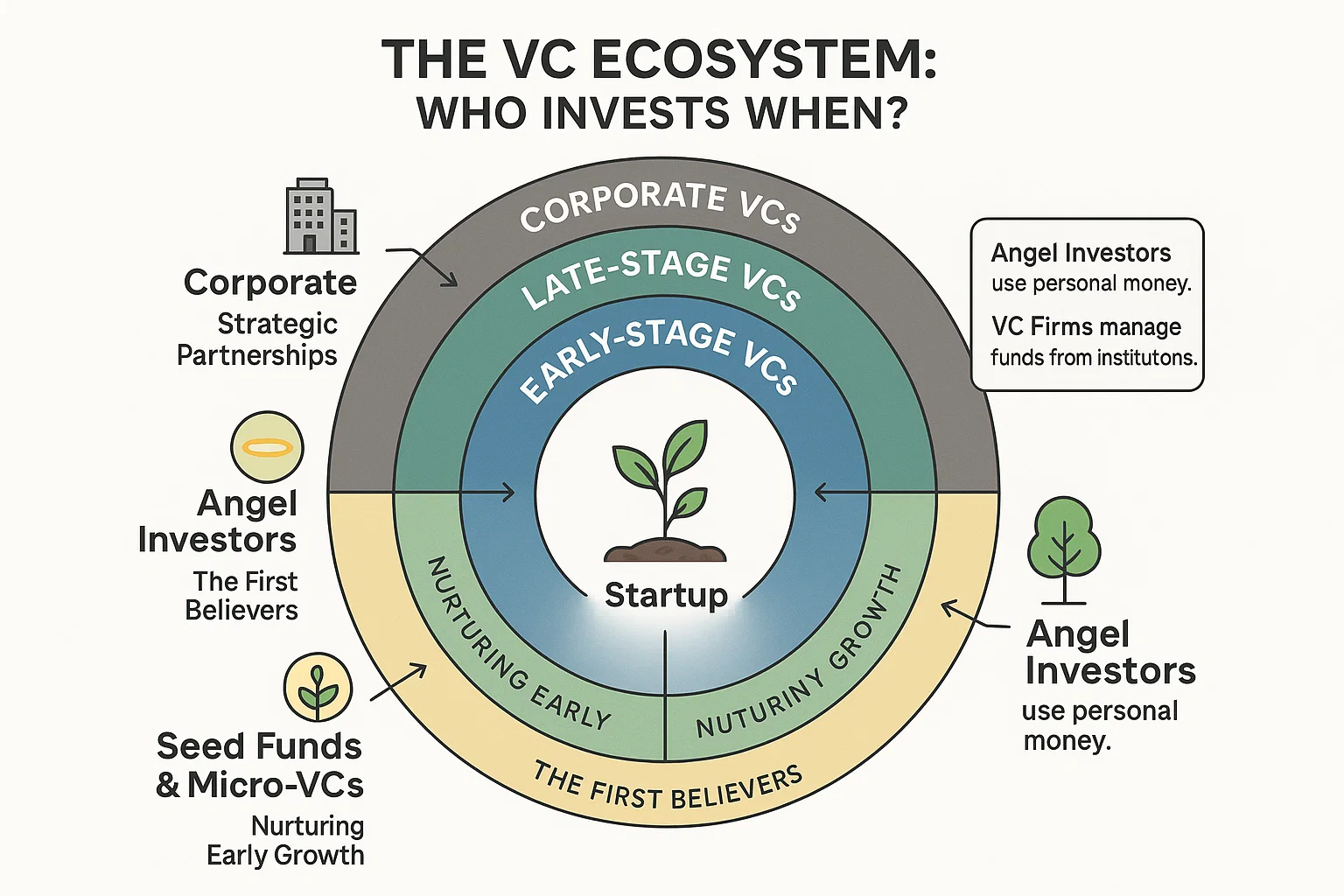

The Different Types of Venture Capital Companies

This is where it gets curiously. Not all VC firms are the same. They have diverse styles, centers, and cravings for hazard. Understanding types of venture capital companies is like knowing the contrast between a sprint and a marathon.

1. Angel Investors

These are the most punctual of early-stage speculators. Regularly, they are effective business people themselves who need to offer assistance the following era. They contribute their claim cash, more often than not in generally little sums, when a company is small more than an thought and a enthusiastic founder.

What they do: Give seed financing to get a concept off the ground.

Their superpower: Speed and adaptability. They can make a choice to contribute without exploring a huge partnership.

2. Seed Funds

Think of this as the official to begin with circular of VC. Seed reserves are little firms that specialize in this "serviette outline" stage. They offer assistance a company discover its item its to begin with clients and demonstrate that its thought has legs.

What they do: Give capital for advertise investigate, item improvement, and building an introductory team.

Their superpower: Sustaining crude, dubious talent.

3. Early-Stage Venture Capital

These are the classic VC firms you likely think of. They come in when a company has a item and a few early clients but needs genuine capital to scale up. This is where the huge checks begin to get written.

What they do: Finance Arrangement A and B rounds to offer assistance a company develop its group, promoting, and deals operations.

Their superpower: Operational skill and profound systems for contracting and commerce development.

4. Late-Stage Venture Capital

These firms contribute in companies that are as of now fruitful and are on a clear way to going open (IPO) or being procured. The hazard is lower, but the check sizes are much, much larger.

What they do: Give development capital to offer assistance a overwhelming player prevail unused markets or battle off competitors.

Their superpower: Planning a company for the investigation of the open markets.

5. Corporate Venture Capital (CVC)

This is when a enormous company, like Google or Intel, has its claim VC arm. They contribute in new companies that are deliberately critical to their center trade. It’s not fair almost money related returns; it’s around development and remaining ahead of the curve.

- What they do: Contribute in new businesses that may gotten to be future accomplices, providers, or procurement targets.

- Their superpower: Giving get to to gigantic corporate assets and conveyance channels.

6. Micro-VCs

These are littler, agile reserves that have gotten to be progressively well known. They frequently center on exceptionally particular specialties, like SaaS for little businesses or climate tech. They fill the crevice between blessed messenger financial specialists and bigger seed funds.

- What they do: Make numerous little wagers on exceptionally early-stage companies.

- Their superpower: Hyper-specialization and a hands-on approach.

It’s a interesting feeling, wagering on a individual more than a spreadsheet, but that’s frequently what early contributing comes down to.

The Stages of Venture Capital Funding

A company’s travel with VC is a story told in chapters, known as subsidizing rounds. Each circular has a diverse reason and includes distinctive sorts of wander capital players.

You Must Also Like: BlackRock Equity Index Fund Review & Fidelity

Pre-Seed Financing: The "companion and family" circular. This is regularly the founder's possess investment funds, or little checks from individuals who accept in them by and by. The objective is to construct a prototype.

Seed Financing: The to begin with official value circular. The objective is to back item improvement and introductory showcase section. Blessed messenger financial specialists and seed reserves are the stars here.

Series A Financing: The company has a item and a few clients, but presently it needs a repeatable and adaptable trade show. Early-stage VCs lead this round.

Series B Financing: Time to scale. The trade show is demonstrated, and the capital is utilized for growing advertise reach, developing the group, and beating competitors. Late-stage VCs regularly connect here.

Series C and Past: These are for fruitful companies looking to grow into unused markets, procure other businesses, or get prepared for an IPO. The financial specialists here are ordinarily late-stage VCs, support reserves, and private equity.

The Core Features of Venture Capital

So, what makes VC distinctive from a bank advance? A few key highlights of wander capital set it apart.

High Chance, Tall Return: VCs anticipate most of their speculations to come up short. They depend on a few "domestic runs" to make the whole finance profitable.

Equity Financing: VCs get possession in the company. Their victory is tied specifically to the company's success.

Long-Term Skyline: This isn't a speedy flip. VCs regularly contribute for 5-10 a long time some time recently seeing a return.

Active Inclusion: They do not fair compose a check. They take a situate on the board, offer key counsel, and open their Rolodex to offer assistance the company enlist and discover partners.

Staged Financing: Capital is given in rounds, as the company hits certain points of reference. This secures the financial specialist and propels the founder.

Venture Capital Careers and Jobs: Who Actually Works in VC?

What does a day in the life of a VC see like? The way to wander capital careers is less of a straight line and more of a wilderness gym.

Analyst: This is frequently the entry-level part. Examiners are inquire about machines. They scour the advertise for unused patterns, meet with incalculable new companies, and construct budgetary models. It’s a crash course in the industry.

Associate: Partners do much of the same as Investigators but with more obligation. They lead due perseverance on potential ventures and begin to construct their claim organize of founders.

Principal / Bad habit President (VP): These are the deal-drivers. They source modern speculation openings, arrange term sheets, and regularly have a situate on the sheets of portfolio companies.

Partner / Common Accomplice (GP): The pioneers of the firm. They have the last say on ventures, oversee the fund's speculators (called Restricted Accomplices), and are the open confront of the firm. Most Accomplices were once fruitful authors or administrators themselves.

Breaking into wander capital occupations is famously intense. There are distant less spots than in managing an account or counseling. Most individuals get in by to begin with getting to be a originator, a space master (like a brilliant build), or by working in a startup and making a title for themselves.

How to Invest in Venture Capital (As an Outsider)

For a long time, this was a amusement as it were for the ultra-wealthy. But that’s changing. So, how to contribute in wander capital if you're not a millionaire?

Become an Blessed messenger Financial specialist: If you have a tall net worth (rules change by nation), you can connect an blessed messenger organize and begin composing little checks straightforwardly to startups.

VC Fund-of-Funds: These are stores that contribute in a portfolio of other VC reserves. The minimums can be tall, but it’s a way to get differentiated exposure.

Crowdfunding Stages: Destinations like SeedInvest and StartEngine permit non-accredited speculators to put little sums of cash into new businesses. The chance is extraordinary, but the boundary to passage is low.

Publicly Exchanged Instruments: A few expansive VC firms, like a16z, are making reserves that are more available. You can moreover contribute in freely exchanged companies that act like VCs, such as Berkshire Hathaway or SoftBank, in spite of the fact that it's not a immaculate play.

The most critical run the show? Never contribute more than you are willing to lose entirely.

Hot Trends in Venture Capital Right Now

The VC world is never inactive. Here’s what’s warming up.

The Rise of Affect Contributing: VCs are progressively looking for companies that can convey both a monetary return and a positive social or natural affect. Think climate tech and economical agriculture.

Healthcare Wander Capital is Booming: The widespread quickened speculation in biotech, advanced wellbeing, and telemedicine. The potential to both spare lives and construct gigantic businesses has never been clearer.

Geoarbitrage: VCs are chasing for ability and esteem exterior of conventional centers like Silicon Valley. New companies in cities like Miami, Austin, and over Latin America and Southeast Asia are getting more attention. The "Retailization" of VC: As said, unused stages are opening up startup contributing to ordinary individuals, democratizing an once-exclusive club.

A Center on Productivity: After a long time of financing "development at all costs," numerous VCs are presently pushing their companies to have a clear, beneficial commerce demonstrate sooner.

Common Mistakes and a Few Real-Life Tales

Many authors dream of a single, enchanted assembly that leads to a check. The reality is distant messier.

A common botch authors make is taking cash from the off-base sort of speculator. A deep-tech startup taking cash from a VC that specializes in quick-flip shopper apps is a formula for dissatisfaction. The venture capital process is a marriage, and arrangement on vision and values is everything.

Look at a company like Airbnb. It was rejected by nearly each major VC. Why? The thought of outsiders remaining in your domestic appeared as well peculiar, as well unsafe. But a seed finance named Sequoia Capital saw the potential in the community and the show.

They contributed $600,000 early on. That stake was in the long run worth billions. It’s a culminate case of how VC isn't around picking a beyond any doubt thing—it's approximately seeing a glint of a colossal plausibility where others see as it were risk.

The Future of Venture Capital

So, where is all this heading? The industry is getting to be more specialized, more worldwide, and more available. The another decade will see unused stores centering solely on AI, on the metaverse, or on understanding climate alter. The types of venture capital will proceed to increase and evolve.

The opportunity for originators, and for those looking to venture capital careers, has never been more prominent. The instruments to construct a company are cheaper and more available than ever, and the capital is there for the right ideas.

Wrapping Up

Venture capital is the motor behind so much of the development we see in our every day lives. From the phone in your stash to the apps you utilize to interface with companions, VC played a portion. Understanding its landscape—from the blessed messenger financial specialists wagering on a dream to the late-stage mammoths planning companies for the world stage—helps you get it how the future gets built.

Frequently Asked Questions

What are the 4 types of venture capital?

These four stages can often be defined by where the investor is in the lifecycle of investment: Seed Capital (for getting started), Early-Stage (for launching and early growth activities), Late-Stage (scaling a proven business), and Mezzanine Financing (getting ready to go public). Each stage is served by distinct types of venture capital firm with its unique expertise.

How do I start a career in venture capital?

A career in venture capital usually starts with expertise in something else. A lot of people begin as founders, software engineers or in operational positions for startups. Another route is to be hired as an Analyst out of undergrad, but these positions are very competitive. Creating a strong network and contributing your smart thoughts to an industry blog can also be game changers.

What is the difference between private equity and venture capital?

It works something like this: Venture capital — the kind of financing that even needs the supervening face of God — finances young, risky companies with huge potential for growth. Generally speaking, private equity purchases old, established companies — often using loads of borrowed money — only to cut and squeeze them in the name of profit. VC is about future betting; private equity is about perfecting what already is.

Is venture capital a good career?

It can be incredibly rewarding. You’re ahead of the curve, surrounded by some pretty brilliant people, and there’s financial upside if it takes off. But it is also high-pressure, requires saying “no” 99 times for every “yes,” and carries the emotional weight of watching countless investments fail. For some it is not, but for others it’s a fantastic venture capital career.

What are the current trends in healthcare venture capital?

Healthcare venture capital trends are super exciting right now. There is huge investment in telemedicine, which makes healthcare more of a reality to millions. Biotech is on fire, with companies springing up to take on diseases that were previously thought untreatable. And there’s a major push into mental health tech and using A.I. to find new drugs and diagnose diseases more quickly.